UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to | Sec. 240.14a-12 |

TCW FUNDS, INC.

(Name of Registrant as Specified In Itsin its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than theother than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) |

| 1. | Title of each class of securities to which | |||

| 2. | Aggregate number of securities to which transaction applies: | |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |||

| 4. | Proposed maximum aggregate value of transaction: | |||

| 5. | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and |

| 6. | Amount Previously Paid: | |||

| 7. | Form, Schedule or Registration Statement No.: | |||

TCW FUNDS, INC.

865 South Figueroa Street

Los Angeles, California 90017

TCW Balanced Fund

TCW Concentrated Value Fund

TCW Dividend Focused Fund

TCW Growth Fund

TCW Growth Equities Fund

TCW Large Cap Growth Fund

TCW Relative Value Large Cap Fund

TCW Relative Value Small Cap Fund

TCW Select Equities Fund

TCW Small Cap Growth Fund

TCW Value Opportunities Fund

TCW Core Fixed Income Fund

TCW High Yield Bond Fund

TCW Money Market Fund

TCW Short Term Bond Fund

TCW Total Return Bond Fund

TCW Emerging Markets Equities Fund

TCW Emerging Markets Income Fund

TCW Aggressive Allocation Fund

TCW Conservative Allocation Fund

TCW Moderate Allocation Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on August 17, 2010

Notice is hereby given that a special meeting of shareholders of TCW Funds, Inc. (the “Company”) will be held at the JW Marriott Hotel, 900 West Olympic Blvd., Los Angeles, CA 90015, Tuesday, August 17, 2010 at 9:30 a.m. Pacific Daylight Time, to consider and vote on the following matters:

Shareholders of record as of the close of business on June 30, 2010 are entitled to notice of and to vote at the special meeting or any adjournment thereof. To assure your representation at the special meeting, please mark, sign and date your proxy card and return it in the envelope provided after reading the accompanying proxy statement.

By Order of the Board of Directors

PHILIP K. HOLL

Secretary

July 8, 2010

We urge you to promptly mark, sign and date the enclosed proxy and return it in the enclosed envelope thus enabling the Company to avoid unnecessary expense and delay. No postage is required if mailed in the United States. In addition to voting by mail you may also vote by telephone or via the internet. Instructions for these options are found on the enclosed proxy card materials. The proxy is revocable and will not affect your right to vote in person if you attend the special meeting.

TCW FUNDS, INC.

865 South Figueroa Street

Los Angeles, California 90017

(213) 244-0000

October 10, 2012

Dear Shareholder:

The enclosed Proxy Statement contains important information about a proposal we recommend be approved by the shareholders of each mutual fund (each, a “Fund”) that is a series of TCW Funds, Inc. (the “Corporation”). The proposal will be considered at a Special Meeting of Shareholders to be held on Wednesday, November 28, 2012.

Shareholders of each Fund are being asked to approve a new investment advisory and management agreement (the “New Agreement”) with TCW Investment Management Company, the Funds’ current investment adviser (the “Adviser”).

The Adviser currently serves as the investment adviser to each Fund under an Investment Advisory and Management Agreement (the “Current Agreement”) that is expected to automatically terminate as a result of its deemed “assignment” under the Investment Company Act of 1940, as amended. The expected change in ownership of The TCW Group, Inc., the parent company of the Adviser, would technically cause that assignment and subsequent termination. The New Agreement has substantively the same terms as the Current Agreement, including the same fees. Subject to obtaining approval of the New Agreement for the Funds, the Adviser would continue to act as the investment adviser to the Funds, with no break in the continuity of its investment advisory services to the Funds.

The Board of Directors of the Corporation (the “Board”) voted unanimously to approve the proposal with respect to each Fund. The Board believes that the proposal is in the best interests of each Fund and its shareholders. The Board recommends that you vote in favor of the proposal in the Proxy Statement.

The Proxy Statement describes the voting process for shareholders.We ask you to read the Proxy Statement carefully and vote in favor of the proposal. The proxy votes will be reported at the Special Meeting of Shareholders scheduled for Wednesday, November 28, 2012. Please submit your proxy via the internet, phone or mail as soon as possible. Specific instructions for these voting options are found on the enclosed proxy voting form.

Sincerely,

/s/ Michael E. Cahill

MICHAEL E. CAHILL

Secretary

TCW FUNDS, INC.

865 South Figueroa Street

Los Angeles, California 90017

(213) 244-0000

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 28, 2012

To the Shareholders of each Fund:

NOTICE IS HEREBY GIVEN that a SPECIAL MEETING OF SHAREHOLDERS (the “Meeting”) of the TCW Concentrated Value Fund, TCW Core Fixed Income Fund, TCW Dividend Focused Fund, TCW Emerging Markets Income Fund; TCW Emerging Markets Local Currency Income Fund, TCW Enhanced Commodity Strategy Fund, TCW Global Bond Fund, TCW Global Conservative Allocation Fund, TCW Global Flexible Allocation Fund, TCW Global Moderate Allocation Fund, TCW Growth Equities Fund, TCW Growth Fund, TCW High Yield Bond Fund, TCW International Small Cap Fund, TCW Relative Value Large Cap Fund, TCW Select Equities Fund, TCW Short Term Bond Fund, TCW Small Cap Growth Fund, TCW SMID Cap Growth Fund, TCW Total Return Bond Fund, and TCW Value Opportunities Fund (each a “Fund” and, together, the “Funds”), each a series of TCW Funds, Inc. (the “Corporation”), will be held on Wednesday, November 28, 2012, at 9:30 a.m. Pacific time at The LA Hotel Downtown located at 333 S. Figueroa Street, Los Angeles, CA 90071 for the following purposes:

| 1. | For each Fund listed above, to approve a new investment advisory and management agreement between the Corporation and TCW Investment Management Company, the Funds’ current investment adviser; and |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments thereof. |

Shareholders of record of the Corporation at the close of business on September 28, 2012 (the “Record Date”) are entitled to notice of, and to vote on, the proposal at the Meeting or any adjournment thereof. Shareholders of each Fund listed above, voting separately by Fund, are entitled to vote on the proposal.

As a shareholder of one or more of the Funds on the Record Date, you are asked to attend the Meeting either in person or by proxy. If you are unable to attend the Meeting in person, we urge you to vote by proxy. You can do this by completing, signing, dating, and promptly returning the enclosed proxy card in the enclosed postage-prepaid envelope, by telephone or electronically utilizing the internet. Specific instructions for each voting option are found on the enclosed proxy form. Your prompt voting by proxy will help assure a quorum at the Meeting and avoid the delay and distraction associated with further solicitation. Voting by proxy will not prevent you from voting your shares at the Meeting if you decide to attend in person. You may revoke your proxy before it is exercised at the Meeting by submitting to the Secretary of the Corporation a written notice of revocation or a subsequently signed proxy card.

PLEASE RETURN YOUR PROXY CARD PROMPTLY

IN ACCORDANCE WITH THE INSTRUCTIONS NOTED ON THE ENCLOSED PROXY CARD.

By Order of the Board of Directors

/s/ Michael E. Cahill

MICHAEL E. CAHILL

Secretary

Dated: October 10, 2012

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE IN FAVOR OF THE PROPOSAL. YOUR VOTE IS IMPORTANT REGARDLESS OF HOW MANY SHARES YOU OWN.

PROXY STATEMENT

The accompanying proxy statementSPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 28, 2012

Introduction

This Proxy Statement is furnished in connection with the solicitation of proxies by or on behalf of the Board of Directors (the “Proxy Statement”) relates to all currently active series (each a “Fund”“Board”) of TCW Funds, Inc. (the ““Corporation”) for use at the Special Meeting of Shareholders of each mutual fund that is a series of the Corporation (the “Meeting”) to be held on Wednesday, November 28, 2012 at 9:30 a.m. Pacific time at The LA Hotel Downtown located at 333 S. Figueroa Street, Los Angeles, CA 90071, and at any adjournment thereof. The Corporation expects to mail this Proxy Statement, the Notice of Special Meeting of Shareholders and the accompanying proxy card on or about Monday, October 15, 2012 to shareholders of the Corporation as of the record date specified below.

The Corporation is an open-end, management investment company, as defined in the Investment Company” Act of 1940, as amended (the “Investment Company Act”). The principal executive offices of the Corporation are located at 865 South Figueroa Street, Los Angeles, California 90017. The Corporation offers shares of twenty-one separate operational series or funds (each a “Fund” and, together, the “Funds”), each of which may offer more than one share class, as follows:

TCW Concentrated Value Fund

TCW Core Fixed Income Fund

TCW Dividend Focused Fund

TCW Emerging Markets Income Fund

TCW Emerging Markets Local Currency Income Fund

TCW Enhanced Commodity Strategy Fund

TCW Global Bond Fund

TCW Global Conservative Allocation Fund

TCW Global Flexible Allocation Fund

TCW Global Moderate Allocation Fund

TCW Growth Equities Fund

TCW Growth Fund

TCW High Yield Bond Fund

TCW International Small Cap Fund

TCW Relative Value Large Cap Fund

TCW Select Equities Fund

TCW Short Term Bond Fund

TCW Small Cap Growth Fund

TCW SMID Cap Growth Fund

TCW Total Return Bond Fund

TCW Value Opportunities Fund

1

Each Fund offers Class N and Class I shares, except for the Short Term Bond Fund, which offers only Class I shares.

At the Meeting, shareholders of the Company will be asked to vote on a proposal (the “Proposal”) to approve a new investment advisory and management agreement with TCW Investment Management Company (the “New Agreement”). Shareholders of each Fund, voting separately by Fund, are entitled to vote on the Proposal.

Voting; Revocation of Proxies

All proxies solicited by the Board that are properly executed and received by the Secretary of Directors (the “the Corporation before the Meeting will be voted at the Meeting in accordance with the shareholders’ instructions thereon. A shareholder may revoke the accompanying proxy at any time before it is voted by written notification to the Corporation or by a duly executed proxy card bearing a later date. In addition, any shareholder who attends the Meeting in person may vote by ballot at the Meeting, thereby canceling any proxy previously given. If no instruction is given on a signed and returned proxy card, it will be voted “for” the Proposal and the proxies may vote in their discretion with respect to other matters not now known to the Board that may be properly presented at the Meeting (except with respect to broker non-votes as described below). Any shareholder may vote part of Directors”the shares in favor of the Proposal and refrain from voting the remaining shares or vote them “against” the “Board”)Proposal, but if the shareholder fails to specify the number of shares that the shareholder is voting affirmatively, it will be conclusively presumed that the shareholder’s approving vote is with respect to the total shares that the shareholder is entitled to vote on the Proposal.

All proxies voted, including abstentions and broker non-votes (i.e., where a broker indicates that the underlying shareholder has fixednot provided instructions on a proposal and the broker does not have authority to vote the shares), will be counted toward establishing a quorum. Abstentions and broker non-votes effectively count as votes “against” the Proposal because approval of a minimum number of the outstanding voting securities is required. The Corporation may request that selected brokers or nominees return proxies on behalf of shares for which voting instructions have not been received if doing so is necessary to obtain a quorum for any Fund.

Record Date; Shareholders Entitled to Vote

Shareholders of record of the Funds at the close of business on June 30, 2010, as the record date for determination of shareholdersSeptember 28, 2012 (the “Record Date”) are entitled to notice of, and to vote on, the Proposal at the special meeting of shareholders or

2

Meeting and any adjournment or postponement thereof (the “Special Meeting”). This Proxy Statementthereof. At the close of business on the Record Date, the Funds had the following outstanding shares:

| Concentrated Value Fund | Core Fixed Income Fund | Dividend Focused Fund | Emerging Markets Income Fund | Emerging Markets Local Currency Income Fund | ||||||||||||||||

Class N Shares Outstanding | 71,643 | 44,464,390 | 52,517,762 | 101,568,785 | 8,029,473 | |||||||||||||||

Class I Shares Outstanding | 607,614 | 44,497,782 | 6,503,800 | 429,688,654 | 11,124,535 | |||||||||||||||

Total Fund Votes | 679,257 | 88,962,172 | 59,021,562 | 531,257,439 | 19,154,008 | |||||||||||||||

| Enhanced Commodity Strategy Fund | Global Bond Fund | Global Conservative Allocation Fund | Global Flexible Allocation Fund | Global Moderate Allocation Fund | ||||||||||||||||

Class N Shares Outstanding | 205,751 | 1,058,164 | 66,910 | 1 | 27,636 | |||||||||||||||

Class I Shares Outstanding | 257,290 | 1,022,773 | 1,249,002 | 194,325 | 1,185,531 | |||||||||||||||

Total Fund Votes | 463,041 | 2,080,937 | 1,315,912 | 194,326 | 1,213,167 | |||||||||||||||

| Growth Equities Fund | Growth Fund | High Yield Bond Fund | International Small Cap Fund | Relative Value Large Cap Fund | ||||||||||||||||

Class N Shares Outstanding | 726,422 | 30,425 | 3,090,157 | 1,482,381 | 3,419,831 | |||||||||||||||

Class I Shares Outstanding | 5,575,822 | 88,876 | 7,265,148 | 2,287,583 | 48,847,828 | |||||||||||||||

Total Fund Votes | 6,302,244 | 119,301 | 10,355,305 | 3,769,964 | 52,267,659 | |||||||||||||||

| Select Equities Fund | Short Term Bond Fund | Small Cap Growth Fund | SMID Cap Growth Fund | Total Return Bond Fund | Value Opportunities Fund | |||||||||||||||||||

Class N Shares Outstanding | 15,847,813 | N/A | 7,513,338 | 1,648,688 | 212,934,129 | 1,641,227 | ||||||||||||||||||

Class I Shares Outstanding | 39,441,222 | 1,588,503 | 31,014,303 | 2,168,449 | 537,068,299 | 4,841,869 | ||||||||||||||||||

Total Fund Votes | 55,289,035 | 1,588,503 | 38,527,641 | 3,817,182 | 750,002,428 | 6,483,141 | ||||||||||||||||||

3

Quorum and accompanying proxy card were first mailed to shareholders on or about July 12, 2010. If you heldAdjournment/Required Vote

One-third (33-1/3%) of the outstanding shares of more than onea Fund on the record date, you will receive separateRecord Date, represented in person or by proxy, cardsmust be present to constitute a quorum for each Fund.

The Board is soliciting proxies from shareholders of each of the Fundsthat Fund with respect to the following proposals:

The Board of Directors solicits and recommends your execution of the enclosed proxy card. SharesProposal. If a quorum for which a properly signed proxy cardFund is received will benot present or represented at the Special Meeting, and will be voted as instructed on the proxy card. Shareholders are urged to specify their choices by marking an “X” in the appropriate box on the proxy card. If no choices are specified,holders of a majority of the shares represented will be voted as recommended by your Board of Directors. A shareholder may revoke a proxy at any time prior to its exercise by filing a written instrument revoking the proxy with the Secretary of the Company,that Fund present in person or by submitting a proxy bearingwill have the power to adjourn the Meeting to a later date, without notice other than announcement at the Meeting (provided that the new date is not more than 120 days after the Meeting), until a quorum is present or represented. Votes cast by proxy or in person at the Meeting will be counted by persons appointed by the Corporation to act as inspectors of election for the Meeting.

The affirmative vote of a “majority of the outstanding voting securities” of a Fund present in person or by attendingproxy and voting is necessary to approve the New Agreement with respect to that Fund.

A “majority of the outstanding voting securities” of a Fund means the affirmative vote of the lesser of (i) 67% or more of the voting securities of the Fund present at the Special Meeting. However, attendanceMeeting, if more than 50% of the outstanding voting securities of the Fund are represented at the Meeting in person or by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund. Each shareholder will be entitled to one vote for each share of each Fund such shareholder holds on the Record Date.

If a quorum is present, but sufficient votes in favor of the Proposal with respect to a Fund are not received by the time scheduled for the Meeting, a person named as a proxy may propose one or more adjournments of the Meeting with respect to the Fund to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of the shares of the Fund present in person or by proxy at the session of the Meeting adjourned. The persons named as proxies will vote in favor of or against such adjournment in proportion to the proxies received for or against the Proposal. Abstentions and broker non-votes will be disregarded for purposes of any vote on whether to adjourn the Meeting.

The Board knows of no business other than that specifically mentioned in the Notice of Special Meeting by itself,of Shareholders that will not revoke a previously submitted proxy.be presented for consideration at the Meeting. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be Held on Tuesday, August 17, 2010. TheWednesday, November 28, 2012. This Proxy Statement and the Company’sCorporation’s most recent annual reportand semi-annual reports are available on the Internet athttp://www.tcw.com. The CompanyCorporation will furnish, without charge, a copy of the Company’sits annual report for itsthe fiscal year ended October 31, 2009,2011, and any morethe most recent reports,semi-annual report for the six months ended April 30, 2012, to any Fund shareholder upon request. To requestShareholders may obtain a copy please write toof the Companyannual report and semi-annual report by contacting TCW Funds, Inc. at 865 South Figueroa Street, Los Angeles, California 90017 or telephoning it at 1-877-829-4768. You may also call for information on how to obtain directions to be able to attend the Special Meeting and vote in person.by calling (800) 386-3829.

1

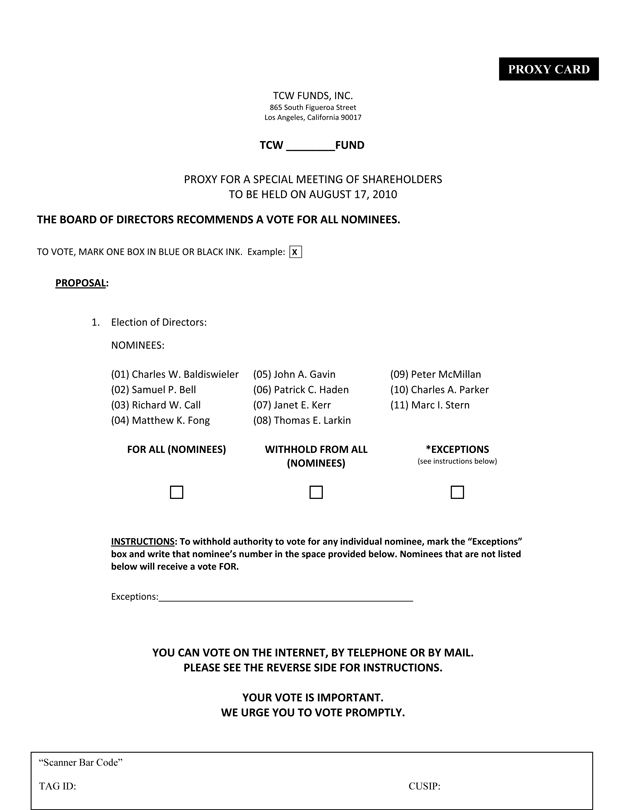

PROPOSAL 1. ELECTION OF DIRECTORS1:

APPROVAL OF A NEW INVESTMENT ADVISORY AND MANAGEMENT AGREEMENT WITH THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR ALL NOMINEESADVISER

Shareholders of each Fund are being asked to approve a new investment advisory and management agreement (the “New Agreement”) between the Corporation and TCW Investment Management Company, each Fund’s current investment adviser (the “Adviser”).

The purposeAdviser currently serves as the investment adviser to each Fund under an Investment Advisory and Management Agreement (the “Current Agreement”) that is expected to automatically terminate as a result of this proposal is to elect the Board of Directors of the Company that will assume office immediately upon election by shareholders. At a Board of Directors meeting held on June 23, 2010, the current Directors of the Company unanimously nominated the eleven persons described below for election as Directors (each a “Nominee”). The Board is currently comprised of nine members. Nine of the Nominees (whose names are preceded by an asterisk (*) are currently members of the Board; two are not. All Nominees have agreed to stand for election, serve if elected and hold office for an unlimited term.

The Company’s Articles of Incorporation do not provide for the annual election of Directors. However, the current Directors wish to add Janet Kerr and Peter McMillan to the Board and may not do so without a shareholder vote becauseits deemed “assignment” under the Investment Company Act of 1940, as amended (the “1940“Investment Company Act”). The expected change in ownership of The TCW Group, Inc. (“TCW”), the parent company of the Adviser, would technically cause that assignment and subsequent termination. The New Agreement has substantively the same terms as the Current Agreement, including the same fees. Subject to obtaining approval of the New Agreement for the Funds, the Adviser would continue to act as the investment adviser to the Funds, with no break in the continuity of its investment advisory services to the Funds. No changes are expected in the services provided to the Funds or in the personnel providing those

services. If approved, the New Agreement would take effect on the consummation of the change of control of TCW, as described below.

The Change of Control

Private equity funds managed by affiliates of The Carlyle Group L.P. (“Carlyle”), in partnership with TCW management, recently signed a definitive agreement to purchase a majority interest in TCW from Société Générale Holding de Participations, S.A. (“SGHP”), a wholly owned subsidiary of Société Générale, S.A. (“SGSA”) (that transaction is referred to as the “Transaction”).

Carlyle, a publicly traded Delaware limited partnership, is one of the world’s largest global alternative asset management firms that originates, structures and acts as lead equity investor in management-led buyouts, strategic minority equity investments, equity private placements, consolidations and buildups, growth capital financings, real estate opportunities, bank loans, high-yield debt, distressed assets, mezzanine debt and other investment opportunities. Carlyle provides investment management services to, and has transactions with, various private equity funds, real estate funds, collateralized loan obligation issuers, hedge funds and other investment products sponsored by it for the investment of client assets in the normal course of business. As of June 30, 2012, Carlyle and its affiliates managed more than $156 billion in assets across 99 funds and 63 fund-of-funds vehicles.

Carlyle will be making its investment in TCW primarily through two of its investment funds, Carlyle Partners V, L.P., a Delaware limited partnership (“CPV”), and Carlyle Global Financial Services Partners, L.P., a Cayman Islands limited

5

partnership (“CGFSP” and, together with CPV, the “Carlyle Funds”). CPV conducts leveraged buyout transactions in North America in targeted industries, and CGFSP invests in management buyouts, growth capital opportunities and strategic minority investments in financial services. The Carlyle Funds are privately offered pooled investment vehicles with their principal place of business at 1001 Pennsylvania Avenue, NW, Suite 220 South, Washington, DC 20004. The general partners of each of the Carlyle Funds (TC Group V, L.P. and TCG Financial Services L.P., respectively), which are responsible for the day-to-day management and oversight of those funds, are affiliates of Carlyle.

Currently, SGHP owns 74.47% of the voting securities of TCW. Immediately prior to the closing of the Transaction, SGHP will acquire the equity of TCW held by Amundi, which represents approximately 19% of the voting securities of TCW. As a result of the Transaction, the ownership interest of TCW management in the equity of TCW will increase from approximately 17% to up to 40%, on a fully diluted basis, with the Carlyle Funds and other investment funds managed by affiliates of Carlyle owning the balance of TCW’s voting securities.

TCW management expects that, subject to the approval of the New Agreement, the Adviser will continue to act as investment adviser to the Funds. The Transaction is expected to close as soon as practicable following satisfaction or waiver of the conditions to closing of the Transaction, which is estimated to be no later than the end of the first quarter of 2013.

As a result of the Transaction, a limited purpose broker-dealer that serves only as a placement agent for interests in various private funds managed by Carlyle and its affiliates will be classified as an affiliate of the Corporation. That broker-dealer will not execute any transactions for the Funds, or any other advisory clients of the Adviser or TCW, and its affiliation will not create any conflict of interest for the Adviser in the course of providing services to the Funds.

The Current Agreement

The Current Agreement dated July 6, 2001 between the Corporation, on behalf of each then-existing Fund, and the Adviser was originally approved in person by the Board, including a majority of the Independent Directors (defined below), at a meeting held on February 21, 2001, and by each Fund’s shareholders on June 26, 2001. The Current Agreement was submitted for shareholder approval because the then-existing investment advisory and management agreement was expected to terminate as a result of the acquisition of TCW by a subsidiary of SGSA. The Current Agreement has remained substantially unchanged since that shareholder approval, except for the addition of various newly created series of the Corporation organized since then. At a meeting held on September 24, 2012, the Board extended the term of the Current Agreement until the earlier of October 31, 2013 and the date on which the Current Agreement would otherwise terminate as a result of its deemed assignment under the Investment Company Act”), resulting from the closing of the Transaction.

6

Under the Current Agreement, the Corporation appointed the Adviser to provide investment advisory and management services with respect to the assets of the Funds. The Current Agreement requires that the Adviser, subject to the direction and supervision of the Board and in conformity with applicable laws, the Corporation’s Articles of Incorporation, Bylaws, Registration Statement, Prospectus and stated investment objectives, policies and restrictions, shall: (i) manage the investment of each Fund’s assets including, by way of illustration, the evaluation of pertinent economic, statistical, financial and other data, the determination of the industries and companies to be represented in that Fund’s portfolio, the formulation and implementation of the Fund’s investment program, and the determination from time to time of the securities and other investments to be purchased, retained or sold by the Fund; (ii) place orders for the purchase or sale of portfolio securities for each Fund’s account with broker-dealers selected by the Adviser; (iii) administer the day to day operations of each Fund; (iv) furnish to the Corporation office space at such place as may be agreed upon from time to time, and all office facilities, business equipment, supplies, utilities and telephone services necessary for managing the affairs and investments and keeping those accounts and records of the Corporation and the Funds that are not maintained by the Corporation’s transfer agent, custodian, accounting or subaccounting agent, and arrange for officers or employees of the Adviser to serve, without compensation from the Corporation, as officers, directors or employees of the Corporation, if desired and reasonably required by the Corporation; and (v) pay such expenses as are incurred by the Adviser in connection with providing the foregoing services (except as otherwise provided in the Current Agreement).

Under the Current Agreement, except as otherwise required under the Investment Company Act, neither the Adviser, nor any director, officer, agent or employee of the Adviser, is liable or responsible to the Corporation or any of its shareholders for any error of judgment, any mistake of law or any loss arising out of any investment, or for any other act or omission in the performance by such person or persons of their respective duties, except for liability resulting from willful misfeasance, bad faith, gross negligence, or reckless disregard of their respective duties. No change is proposed to the Adviser’s standard of care.

The Current Agreement provides that it continues from year to year with respect to each Fund so long as it is approved at least annually with respect to such Fund by a majority of the current Directors may not fill vacancies on the Boardoutstanding voting securities of such Fund or by appointment if, after the appointment, less than two-thirdsa vote of a majority of the Directors holding office would have been elected by the shareholders. Accordingly, the Board has called this Special Meeting to elect Ms. Kerr, Mr. McMillan, and three other current members of the Board who were previously appointed to the Board and to re-elect the six current membersCorporation, including a majority of the Board who were previously elected by the shareholders.

The following schedule sets forth certain information regarding each Nominee, including his or her age, address and positions with the Company, the length of time he or she has served as Director, the Nominee’s principal occupations during the past five years (his or her titles may have varied during the period), the total number of separate portfolios in the fund complex the Nominee would oversee if elected, and certain other board memberships held by the Nominee during the past five years.

NomineesDirectors who are not “interested persons” of the Fund under the Investment Company Act (the “Independent Directors”) and who are not parties to the Current Agreement.

The Current Agreement permits termination without penalty upon no less than 60 days’ notice by the Corporation to the Adviser or 60 days’ notice by the Adviser to the Corporation and automatically terminates in the event of its assignment (as that term is defined in the 1940 Act ) are referred to as “Independent Directors.” Nominees who are “interested persons” of theInvestment Company under the 1940 Act are referred to as “Interested Directors.”Act).

2

Independent Director NomineesManagement Fees and Other Expenses

Management Fees. Under the Current Agreement, each Fund pays the Adviser a monthly fee for providing investment advisory services. The following fees were paid to the Adviser for the fiscal year ended October 31, 2011, and do not reflect expense limitations and contractual fee waivers. Also shown are the contractual fee rates from the Current Agreement.

|

|

| ||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

| ||||||||

3

|

|

| ||||||

| ||||||||

| ||||||||

Fund | Total Gross Advisory Fees Paid for Fiscal Year Ended October 31, 2011 (excluding fees waived or reduced) | Contractual Annual Fee Rate | Total Recoupable Fees Waived by Adviser for Fiscal Year Ended October 31,2011(5) | |||||||

Concentrated Value Fund | $ | 335,000 | 0.65 | % | N/A | |||||

Dividend Focused Fund | $ | 4,833,000 | 0.75 | % | N/A | |||||

Growth Fund | $ | 188,000 | 0.75 | % | N/A | |||||

Growth Equities Fund | $ | 1,195,000 | 1.00 | % | N/A | |||||

Relative Value Large Cap Fund | $ | 3,520,000 | 0.75 | % | N/A | |||||

Select Equities Fund | $ | 4,092,000 | 0.75 | % | N/A | |||||

Small Cap Growth Fund | $ | 10,693,000 | 1.00 | % | N/A | |||||

SMID Cap Growth Fund | $ | 206,000 | 1.00 | % | N/A | |||||

Value Opportunities Fund | $ | 1,681,000 | 0.80 | % | N/A | |||||

International Small Cap Fund | $ | 109,000 | 0.75 | % | N/A | |||||

Core Fixed Income Fund | $ | 1,386,000 | 0.40 | % | N/A | |||||

Emerging Markets Income Fund | $ | 15,732,000 | 0.75 | % | N/A | |||||

Emerging Markets Local Currency Income Fund(1) | $ | 474,000 | 0.75 | % | N/A | |||||

High Yield Bond Fund | $ | 685,000 | 0.75 | % | N/A | |||||

Short Term Bond Fund | $ | 88,000 | 0.50 | % | N/A | |||||

Total Return Bond Fund | $ | 22,263,000 | 0.50 | % | N/A | |||||

Enhanced Commodity Strategy Fund(2) | $ | 14,000 | 0.50 | % | $110,000 | |||||

Global Bond Fund(3) | $ | 0 | 0.55 | % | N/A | |||||

Global Conservative Allocation Fund(4) | $ | 0 | 0.00 | % | N/A | |||||

Global Moderate Allocation Fund(4) | $ | 0 | 0.00 | % | N/A | |||||

Global Flexible Allocation Fund(4) | $ | 0 | 0.00 | % | N/A | |||||

| (1) | The |

| (2) |

|

4

Interested Director Nominees(3)

|

|

|

| |||||

| ||||||||

| ||||||||

| ||||||||

|

|

8

| (4) | The TCW Global Conservative Allocation Fund, the TCW Global Moderate Allocation Fund and the TCW Global Flexible Allocation Fund (the “Asset Allocation Funds”) are funds of funds, each of which seeks to achieve its investment objective by investing primarily in the Class I shares of other TCW Funds and various classes of certain funds managed by Metropolitan West Asset Management, LLC (“MWAM”), an affiliate of the |

Under the Current Agreement, fees and expenses of a |

All proxies willIn addition to the management fees, the Corporation reimburses the Adviser, with the approval of the Board, for a portion of the Adviser’s costs associated in support of the Corporation’s compliance obligations pursuant to Rule 38a-1 under the Investment Company Act.

Rule 12b-1 Fee. The Funds each have a Distribution Plan or 12b-1 Plan (the “Plan”) under which they may finance activities primarily intended to result in the sale of Fund shares and to provide shareholder services to the shareholders of the class of the Funds to which the Plan applies, provided that the Board reviews, at least quarterly, a written report of the amounts so expended under the Plan and the purposes for which such expenditures were made. Expenditures by a Fund under its Plan may not exceed 0.25% of its average net assets annually (all of which may be for service fees). Currently, the Board is limiting these fees to less than 0.25% for the TCW Growth Fund, TCW Growth Equities Fund, TCW SMID Cap Growth Fund, TCW Value Opportunities Fund, TCW International Small Cap Fund, TCW Emerging Markets Local Currency Income Fund, TCW Core Fixed Income Fund, TCW High Yield Bond Fund, TCW Short Term Bond Fund, TCW Total Return Bond Fund, TCW Global Conservative Allocation Fund, TCW Global Moderate Allocation Fund, TCW Global Flexible Allocation Fund, TCW Enhanced Commodity Strategy Fund, and TCW Global Bond Fund.

Compensation of Other Parties. The Adviser may in its discretion and out of its own resources compensate third parties for the sale and marketing of Fund shares and for providing services to shareholders. The Adviser also may use its own resources to sponsor seminars and educational programs on the Funds for financial intermediaries and shareholders.

9

The Adviser also manages individual investment advisory accounts, typically for institutional clients. The Adviser reduces the fees charged to individual investment advisory accounts by the amount of the investment advisory fee charged to that portion of the client’s assets invested in any Fund.

Affiliated Brokerage.For the fiscal year ended October 31, 2011, TCW High Yield Bond Fund paid $40.00 in aggregate commissions to Newedge USA, LLC (“Newedge”), an affiliated broker of the Corporation. This amount represents 1.55% of the aggregate brokerage commissions paid by the Fund during 2011. These figures imply total commissions that may appear modest for a Fund of this size. It is important to note that the Fund typically does not pay brokerage commissions on its bond transactions because those transactions occur on a principal basis rather than an agency basis on which commissions would be charged. Brokerage commissions paid to Newedge by TCW High Yield Bond Fund related to trades for futures contracts. Newedge is a wholly owned subsidiary of Newedge Group, which is 50% owned by SGSA, the ultimate parent company of the Adviser. During the fiscal year ended October 31, 2011, no other Fund paid commissions to an affiliated broker of the Corporation.

Comparison of the Current Agreement and the New Agreement

The Board, together with the requisite number of Independent Directors, voted in favorperson on September 24, 2012 to approve the New Agreement. The Board is recommending to shareholders of each Fund that they approve the New Agreement. A copy of the Nominees listed inNew Agreement is attached to this Proxy Statement unless a contrary indicationasAppendix B. The New Agreement is made. If, priorsubstantially identical to the Special Meeting, any Nominee becomes unableCurrent Agreement as described above in all material respects, except for the commencement and renewal dates. The initial term of the New Agreement would extend for two years from its execution date, after which it would continue from year to serve,year with respect to each Fund subject to the proxiessame approval process as described above for the Current Agreement.

This discussion of the New Agreement is qualified in its entirety by reference toAppendixB.

Board Actions, Considerations, and Recommendations

At an in-person meeting of the Board held on September 24, 2012, the Directors, including the Independent Directors, considered the approval of the New Agreement in respect of each Fund. In determining to approve the New Agreement, the Directors considered that they had approved the continuation of the Current Agreement, the terms of which would have otherwise been votedare substantially identical to the New Agreement, for such Nominee will be votedan additional year at the same in-person meeting.

Continuation of the Current Agreement

The Adviser provided materials to the Board on August 30, 2012 and September 4, 2012, and as part of the board materials for such substitute nominee as may be selectedthe September 24 meeting for

10

its evaluation of the Current Agreement in response to information requested by the

Independent Directors, who were advised by independent legal counsel with respect to these and other relevant matters. The Independent Directors also met separately on September 10, 2012 with their counsel to consider the information provided. As a result of those meetings and their other meetings, the Independent Directors unanimously recommended continuation of the Current Agreement. Discussed below are certain of the factors considered by the Board in approving continuation of Directors.the Current Agreement. This discussion is not intended to be all-inclusive. The Board reviewed a variety of factors and considered a significant amount of information, including information received on an ongoing basis at Board and committee meetings. The approval determination was made on the basis of each Director’s business judgment after consideration of all the information taken as a whole. Individual Directors may have given different weight to certain factors and assigned various degrees of materiality to information received in connection with the contract review process.

In reaching its decision to approve continuation of the Current Agreement, the Board considered information furnished to it throughout the year at regular and special Board meetings, including detailed investment performance reports. The structure and format for this regular reporting was developed in consultation with the Board. The Board determined that it had received from the Adviser such information before the Meeting and on an ongoing basis as was reasonably necessary to approve continuation of the Current Agreement. The approval determination was made on the basis of each Director’s business judgment after consideration of all the information taken as a whole.

In evaluating the continuation of the Current Agreement the Board, including the Independent Directors, considered the following factors among others.

| 1. | Nature, Extent, and Quality of Services |

The Board considered the general nature, extent, and quality of services provided or expected to be provided by the Adviser. The Board evaluated the Adviser’s experience in serving as manager of the Funds, and considered the benefits to shareholders of investing in a fund complex that is served by a large organization which also serves a variety of other investment advisory clients, including separate accounts, other pooled investment vehicles, registered investment companies and commingled funds. The Board also considered the ability of the Adviser to provide appropriate levels of support and resources to the Corporation.

In addition, the Board took note of the background and experience of the senior management and portfolio management personnel of the Adviser and that the Adviser is expected to provide substantial expertise and attention to the Corporation. The Board considered the ability of the Adviser to attract and retain qualified business professionals and its compensation program, including its employee equity plan. The

5

OwnershipBoard also considered the breadth of Securitiesthe compliance programs of the Adviser, as well as the compliance operations of the Adviser with respect to the Funds. The Board concluded that it was satisfied with the nature, extent and quality of the services provided and anticipated to be provided to the Funds by the Adviser under the Current Agreement.

| 2. | Investment Performance |

The Board reviewed information about each Fund’s historical performance, including materials prepared by the Advisor and a report prepared by Morningstar Associates LLC, an independent third party consultant, which provided a comparative analysis of each Fund with the performance of similar funds over one, three, five and 10 year periods ended June 30, 2012, as applicable. The Directors noted that the investment performance of most of the Funds was satisfactory for multiple periods. The Board concluded that the Adviser should continue to provide investment advisory and management services to the Funds. The Board indicated it would continue to monitor Fund investment performance on a regular basis and discuss with the Adviser from time to time any instances of long-term underperformance as appropriate.

| 3. | Advisory Fees and Profitability |

The Board considered information in the materials prepared by the Adviser regarding the advisory fees charged to the Funds, advisory fees paid by other funds in the Funds’ respective peer groups, and advisory fees paid to the Adviser under advisory contracts with respect to other institutional clients. The Board noted that although the advisory fees charged by the Adviser to several of the Funds are above the fees paid by peer groups of similar funds, in most cases those Funds had above-average performance for multiple periods and total expenses below or very close to their respective peer group averages. The Board also noted that the advisory fees charged by the Adviser to many of the Funds are higher than the advisory fees charged by the Adviser to certain institutional separate accounts with similar strategies managed by the Adviser, but that the services provided the Funds are more extensive than the services provided to institutional separate accounts.

The Board noted that the total expenses of the Funds are near or below expenses incurred by other funds in their respective peer groups. They considered that the Adviser has agreed to reduce its investment advisory fee or pay the operating expenses of each Fund in order to maintain the overall expense ratios of the Funds at competitive levels (the “Expense Limitations”), that the Adviser had entered into contractual expense limitation agreements with respect to fifteen Funds and the amounts paid or waived by the Adviser pursuant to expense limitations. The Board also considered the costs of services to be provided and profits to be realized by the Adviser and its affiliates from their relationship with the Corporation. Recognizing the difficulty in evaluating a manager’s profitability with respect to the funds it manages in the context

12

of a manager with multiple lines of business, and noting that other profitability methodologies might also be reasonable, the Board concluded that the profits of the Adviser and its affiliates from their relationship with the Corporation was reasonable. Based on these various considerations, the Board concluded that the contractual management fees of the Funds under the Current Agreement are fair and bear a reasonable relationship to the services rendered.

| 4. | Expenses and Economies of Scale |

The Board considered the potential of the Adviser to achieve economies of scale as the Funds grow in size. The Board noted that the Adviser has agreed to the Expense Limitations, which are designed to maintain the overall expense ratio of each of the Funds at a competitive level. The Board also considered the relative advantages and disadvantages of an advisory fee with breakpoints compared to a flat advisory fee supplemented by advisory fee waivers and/or expense reimbursements. The Board concluded that the current fee arrangements were appropriate given the current size and structure of the Corporation and adequately reflected any economies of scale.

| 5. | Ancillary Benefits |

The Board considered ancillary benefits to be received by the Adviser and its affiliates as a result of the relationship of the Adviser with the Corporation, including compensation for certain compliance support services. The Board noted that, in addition to the fees the Adviser receives under the Current Agreement, the Adviser receives additional benefits in connection with management of the Funds in the form of reports, research and other services from brokers and their affiliates in return for brokerage commissions paid to such brokers. The Board concluded that any potential benefits to be derived by the Adviser from its relationships with the Funds are consistent with the services provided by the Adviser to the Funds.

Based on the consideration discussed above and other considerations, the Board, including the Independent Directors, approved continuation of the Current Agreement.

Approval of the New Agreement

Before the September 24 meeting, the Adviser provided materials to the Board for its evaluation of the New Agreement in response to information requested by the Independent Directors, who were advised by independent legal counsel with respect to these and other relevant matters. The Independent Directors also met separately on September 5 and September 10, 2012 with their counsel to consider the information provided and the New Agreement. As a result of those meetings and their other meetings, the Independent Directors unanimously recommended approval of the New Agreement. Discussed below are certain of the factors considered by the Board in approving the New Agreement. This discussion is not intended to be all-inclusive. The Board reviewed a variety of factors and considered a significant amount of

13

information, including information received and considered with respect to continuation of the Current Agreement as described above. The approval determination was made on the basis of each Director’s business judgment after consideration of all the information taken as a whole. Individual Directors may have given different weight to certain factors and assigned various degrees of materiality to information received in connection with the contract review process.

In evaluating the New Agreement, the Board, including the Independent Directors, considered the following factors among others.

The Directors considered that it is not anticipated by the Adviser that there will be any material adverse change in the services provided to the Funds or personnel who are engaged in the portfolio management activities for the Fund as a result of the Transaction. In addition, the consensus of the Independent Directors, based on the information presented to them, was that there would be no “unfair burden” on the Funds as a result of the Transaction within the meaning of Section 15(f) of the Investment Company Act. In particular, the Independent Directors noted that the Adviser represented that there is not expected to be an increase in the contractual advisory fee applicable to any Fund, or additional compensation paid by the Funds to the Adviser, TCW, or their affiliates, as a result of the Transaction. The Directors considered that the terms of the New Agreement are substantially identical in all material respects to those of the Current Agreement.

On the basis of these and other factors, the Directors concluded that it would be in the best interests of each of the Funds to continue to be advised by the Adviser, and voted unanimously, including the unanimous vote of the Independent Directors present at that meeting, to approve the New Agreement, including the advisory fees proposed in the New Agreement, in respect of each of the Funds for a two-year period commencing immediately following the shareholder approval of the New Agreement and the consummation of the Transaction, and to recommend to shareholders of each Fund that they approve the New Agreement as well.

Section 15(f)

The following table sets forthBoard has been informed that the equity ownershipAdviser has agreed to take certain actions to comply with Section 15(f) of Nomineesthe Investment Company Act. Section 15(f) provides a non-exclusive “safe harbor” for an investment adviser or any affiliated persons to receive any amount or benefit in connection with a change in control of the investment adviser as long as two conditions are met. First, for a period of three years after the change of control, at least 75% of the directors of the Corporation must not be “interested persons” of the Adviser as defined in the Fund and in the Fund Complex as of December 31, 2009. The code for the dollar range of equity securities owned by nominees is: (a) $1 to $10,000; (b) $10,001—$50,000; (c) $50,001—$100,000; and (d) over $100,000.Investment Company Act. As of the date of this Proxy Statement, neither Ms. Kerr nor Mr. McMillan ownedless than 75% of the Board is comprised of Independent Directors. It is expected that, before the consummation of the Transaction, one of the Directors who is an interested person of the Adviser will resign his position as director of the Corporation. Following that resignation, the Corporation will meet

14

the first condition for compliance with Section 15(f) discussed above. Second, an “unfair burden” must not be imposed on a Fund as a result of the Transaction or any securitiesexpress or implied terms, conditions, or understandings applicable thereto. The term “unfair burden” is defined in Section 15(f) to include any arrangement during the two-year period after the Transaction whereby an investment adviser or any interested person of any such adviser receives or is entitled to receive any compensation, directly or indirectly, from the investment company or its security holders (other than fees forbona fideinvestment advisory or other services) or from any person in connection with the purchase or sale of securities or other property to, from, or on behalf of the investment company (other thanbona fide ordinary compensation as principal underwriter for such investment company). The Board has been advised that the Adviser, after due inquiry, does not believe that there will be, and is not aware of, any express or implied term, condition, arrangement, or understanding that would impose an “unfair burden” on the Funds as a result of the change of control of TCW. If the Transaction is consummated, SGHP and Carlyle have agreed to share the expenses related to obtaining the approvals of the Funds related to the Transaction, including proxy solicitation, printing, mailing, vote tabulation, and other proxy soliciting expenses, legal fees, and out-of-pocket expenses. If the Transaction is not consummated, SGHP and/or its affiliates would bear these costs.

Vote Required and Recommendation

The affirmative vote of a majority of each Fund’s outstanding voting securities (as defined in the Investment Company Act) is required to approve the New Agreement with respect to such Fund. The Investment Company Act defines a vote of a majority of a fund’s outstanding voting securities as the lesser of (i) 67% or more of the voting securities represented at the meeting if more than 50% of the outstanding voting securities are so represented; or (ii) more than 50% of the outstanding voting securities. If approved by shareholders, the New Agreement will take effect on the consummation of the Transaction. If the New Agreement is not approved with respect to one or more Funds, the Current Agreement with respect to those Funds would automatically terminate on the consummation of the Transaction. In that event, the Board would consider various alternatives such as again seeking shareholder approval of the New Agreement or of a different agreement, allowing the Adviser to manage the affected Fund at cost for a temporary period, hiring a transition manager or new manager, seeking shareholder approval of a reorganization, or liquidating the Fund.

The Board of Directors, including the Independent Directors, believes that the proposal to approve the New Agreement is in the best interests of each Fund and its shareholders. The Board recommends a vote “for” this proposal.

15

GENERAL INFORMATION

Other Matters to Come Before the Meeting

Management of the Corporation does not know of any matters to be presented at the Meeting other than the matter described in this Proxy Statement. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Expenses

If the Transaction is consummated, SGHP and Carlyle have agreed to share the expenses related to obtaining the approvals of the Funds related to the Transaction, including proxy solicitation, printing, mailing, vote tabulation, and other proxy soliciting expenses, legal fees, and out-of-pocket expenses. The expenses are estimated to be approximately $2,000,000. If the Transaction is not consummated, SGHP and/or its affiliates would bear these costs.

Solicitation of Proxies

Solicitation will be primarily by mail, but officers of the Funds or regular employees of the Adviser may also solicit without compensation by telephone, electronic communication, or personal contact. TCW has also retained AST Fund Solutions to assist in the solicitation process.

Adviser

TCW Investment Management Company, with principal offices at 865 South Figueroa Street, Los Angeles, California 90017, acts as the investment adviser to the Funds and generally administers the affairs of the Corporation. The Adviser’s website iswww.tcw.com. Subject to the direction and control of the Board of Directors, the Adviser supervises and arranges the purchase and sale of securities and other assets held in the portfolios of the Funds. The Adviser is a registered investment adviser organized in 1987. The Adviser, together with TCW and its other subsidiaries, managed $127.3 billion of various types of financial assets as of June 30, 2012.

The following table provides the name and principal occupation of each executive officer of the Adviser. The address of each officer and the Chief Executive Officer of the Adviser is c/o TCW Investment Management Company, 865 South Figueroa Street, Los Angeles, California 90017.

|

| ||||

| |||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| |||||

|

| ||||

|

| ||||

Marc I. Stern | Director, Chairman and Chief Executive Officer | ||||

| |||||

16

Officer | Principal Occupation(s) with the Adviser | |

David S. DeVito | Director, Executive Vice President and Chief Administrative Officer | |

Joseph M. Burschinger | Executive Vice President and Chief Risk Officer | |

Stanislas L. Debreu | Executive Vice President | |

Mark W. Gibello | Executive Vice President | |

6

NoneDirectors and Officers of the Independent Director Nominees, or any other member of their immediate family, owned beneficially or of record, any securities in an investment adviser or principal underwriter of a Fund or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with an investment adviser or principal underwriter of a Fund as of June 30, 2010.

Compensation for DirectorsCorporation

The Company pays each Independent Director an annual fee of $45,000 plus a per joint meeting fee of $1,750 for meetings oftable below lists the Board ofcurrent Directors or Committees of the Board of Directors attended by the director, prorated among the Funds. The Chairman of the Audit Committee also receives a $15,000 annual retainer, the Chairman of the Nominating Committee receives an additional $1,500 annual retainer and the Independent Chairman of the Company receives an additional $22,500 annual retainer. Directors are also reimbursed for travel and other out-of-pocket expenses incurred by them in connection with attending such meetings. Directors and officers who are employed by the Advisor or an affiliated company thereof receive no compensation nor expense reimbursement from the Company. Directors do not receive any pension or retirement benefits as a result of their service as a director of the Company.

The following table indicates the compensation paid to the Independent Directors by the Company for the fiscal year ended October 31, 2009. The table also indicates the compensation paid to the Independent Directors for the calendar year ended December 31, 2009 by the TCW Strategic Income Fund, Inc. (“TSI”). TSI is included because the Company’s Advisor also serves as TSI’s investment adviser.

Name of Independent Director* | Aggregate Compensation From the Company | Total Compensation from the Company and TSI | ||||

Samuel P. Bell | $ | 76,750 | $ | 91,250 | ||

Richard W. Call | $ | 63,210 | $ | 77,710 | ||

Matthew K. Fong | $ | 58,000 | $ | 71,750 | ||

John A. Gavin | $ | 61,750 | $ | 76,250 | ||

Patrick C. Haden | $ | 84,250 | $ | 98,750 | ||

Charles A. Parker | $ | 61,750 | $ | 76,250 | ||

The Board of Directors normally meets at least quarterly at regularly scheduled meetings. During the fiscal year ended October 31, 2009, the Board met 4 times. Each incumbent Nominee attended at least 75% of the meetings of the Board held during the last fiscal year, including the meetings of the Board’s standing Committees on which such Director was a member. The Fund does not hold annual meetings, and therefore

7

the Board of Directors does not have a policy with regard to Director attendance at such meetings.

Leadership Structure

The Board is responsible for the overall management of the Company, including general supervision of the duties performed by the Advisor and other service providers in accordance with the provisions of the 1940 Act, other applicable laws and the Company’s Articles of Incorporation and By-Laws. The Board meets in regularly scheduled meetings throughout the year. It is currently composed of nine Directors, including six Independent Directors. As discussed below, the Board has established three committees to assist the Board in performing its oversight responsibilities.

The Board has appointed an Independent Director to serve as its Chairman. The Chairman’s primary role is to set the agenda of the Board and determine what information is provided to the Board with respect to matters to be acted upon by the Board. The Chairman presides at all meetings of the Board and leads the Board through its various tasks. The Chairman also acts as a liaison with management in carrying out the Board’s functions. The Chairman also performs such other functions as may be requested by the Board from time to time. The designation of Chairman does not impose any duties, obligations or liabilities that are greater than the duties, obligations or liabilities imposed on such person as a member of the Board, generally.

The Company has determined that the Board’s leadership structure is appropriate given the characteristics and circumstances of the Company, including such matters as the number of Funds in the Fund Complex, the types of Funds that comprise the Company (e.g., equity and fixed income), the net assets of the Company, the committee structure of the Company and the distribution arrangements of the Company.

Risk Oversight

Through its direct oversight role, and indirectly through its Committees, the Board performs a risk oversight function for the Company consisting, among other things, of the following activities:

General Oversight. The Board regularly meets with the officers of the Company and representatives of key service providers to the Company, including the Advisor, administrator, distributor, transfer agent, custodian and independent registered public accounting firm to review and discuss the operational activities of the Company and to provide direction with respect thereto.

Compliance Oversight. The Board reviews and approves the procedures of the Company established to ensure compliance with applicable federal securities laws. The Board keeps informed about how the Company’s operations conform to its compliance procedures through regular meetings with, and reports received from the Company’s Chief Compliance Officer, and other officers.

8

Investment Oversight.The Board monitors Fund performance during the year through regular performance reports from management with references to appropriate performance measurement indices and the performance of similar funds. The Board also receives focused performance presentations on a regular basis, including special written reports and oral presentations by portfolio managers. In addition, the Board monitors each Fund’s investment practices and reviews its investment strategies with management and receives focused presentations.

Valuation Oversight. The Board has approved the valuation methodologies used in establishing the daily values of the Company’s assets and monitors the accuracy with which the valuations are carried out. The Board receives regular reports on the use of fair value prices and monitors the effectiveness of the Company’s valuation procedures.

Financial Reporting. Through its Audit Committee, the Board meets regularly with the Company’s independent registered public accounting firm to discuss financial reporting matters, the adequacy of the Company’s internal controls over financial reporting, and risks to accounting and financial reporting matters.

Board Committees

The Board has a standing Audit Committee, Executive Committee and Nominating Committee.

The Audit Committee makes recommendations to the Board of Directors concerning the selection of the independent auditors and reviews with the auditors the results of the annual audit, including the scope of auditing procedures, the adequacy of internal controls and compliance by the Company with the accounting, recording and financial reporting requirements of the 1940 Act. The Audit Committee also reviews compliance with the Code of Ethics by the executive officers, directors and investment personnel of the Advisor. The Audit Committee’s current members are Messrs. Bell, Call, Fong, Gavin, Haden and Parker. During the fiscal year ended October 31, 2009, the Audit Committee held four meetings.

The Executive Committee has the same powers as the Board of Directors except the power to declare dividends or other stock distributions, elect directors, authorize the issuance of stock except as permitted by statute, recommend to the shareholders any action requiring their approval, to amend the By-Laws or approve any merger or share exchange not requiring shareholder approval. The Executive Committee’s current members are Messrs. Call, Haden and Stern. During the fiscal year ended October 31, 2009, the Executive Committee held no meetings.

The Nominating Committee has adopted a Nominating Committee Charter, a copy of which is attached to this Proxy Statement. The Nominating Committee makes recommendations to the Board of Directors regarding nominations for membership on

9

the Board of Directors. It evaluates candidates’ qualifications for Board membership and, with respect to nominees for positions as independent directors, their independence from the Company’s investment advisor and other principal service providers. The Nominating Committee does not have any formal policy regarding diversity in identifying nominees for a directorship, but, considers it among the various factors relevant to any particular nominee. The Nominating Committee periodically reviews director compensation and recommends any appropriate changes to the Board. This Committee also reviews and may make recommendations to the Board of Directors relating to those issues that pertain to the effectiveness of the Board in carrying out its responsibilities in governing the Company and overseeing the management of the Company. The current members of the Company’s Nominating Committee are Messrs. Bell, Call, Fong, Gavin, Haden and Parker. During the fiscal year ended October 31, 2009, the Nominating Committee held four meetings.

The following is a brief discussion of the particular experience, qualifications, attributes or skills that led the Board to conclude that each person identified below should serve as a Director of the Company.

Generally, no one factor was decisive in the original selection of the Directors to the Board, nor in the nomination of the Nominee. Qualifications considered by the Board to be important to the selection and retention of Directors include the following: (i) the individual’s business and professional experience and accomplishments; (ii) the individual’s educational background and accomplishments; (iii) the individual’s experience and expertise performing senior policy-making functions in business, government, education, accounting, law and/or administration; (iv) how the individual’s expertise and experience would contribute to the mix of relevant skills and experience on the Board; (v) the individual’s ability to work effectively with the other members of the Board; and (vi) the individual’s ability and willingness to make the time commitment necessary to serve as an effective director. In addition, the individual’s ability to review and critically evaluate information, to evaluate fund service providers, to exercise good business judgment on behalf of fund shareholders, prior service on the Board, and familiarity with the Company are considered important assets.

Charles W. Baldiswieler. Mr. Baldiswieler is a Group Managing Director of the Advisor, TCW Asset Management Company and Trust Company of the West and serves on the board of TSI, a publicly-traded closed end fund. He has over 20 years of experience in the investment industry and prior to joining TCW in 1995 he was Director of Marketing for Jensworld, King and Associates (Houston, Texas). Prior to that he headed the Investment Marketing Department at Bank One Trust (Houston, Texas).

Samuel P. Bell. Mr. Bell, Chairman of the Audit Committee, is a private investor and serves on the boards of Post 360, a post production services company, Broadway National Bank, and TSI, a publicly-traded closed end fund. He previously was

10

President of Los Angeles Business Advisors, a not-for-profit business organization. Prior to 1996, Mr. Bell served as the Area Managing Partner of Ernst & Young, a public accounting firm, for the Pacific Southwest Area.

Richard W. Call. Mr. Call, Chairman of the Nominating Committee, is a private investor and serves on the board of TSI, a publicly-traded closed end fund, since the fund’s inception in 1987. Previously, Mr. Call was President of the Seaver Institute, a private foundation.

Matthew K. Fong. Mr. Fong is President of Strategic Advisory Group, a private equity and real estate consulting firm. He also serves on the boards of Seismic Warning Systems, Inc., PGP, LLP, a private equity fund and TSI, a publicly-traded closed end fund. Mr. Fong is also on the Pepperdine University Board of Regents and the Southwestern School of Law Board of Trustees. Mr. Fong is Of Counsel to Sheppard, Mullin, Richter & Hamilton, a Los Angeles law firm. From 1995 to 1998 Mr. Fong served as Treasurer of the State of California.

John A. Gavin. Mr. Gavin is founder and Chairman of Gamma Holdings, an international capital consulting firm and serves on the boards of Causeway Capital Management Trust and the Hotchkis and Wiley Funds, mutual fund complexes, and TSI, a publicly-traded closed end fund. From 1981 to 1986, Mr. Gavin served as the United States Ambassador to Mexico.

Patrick C. Haden. Mr. Haden, the Independent Chairman of TCW Funds, Inc., is a General Partner in Riordan, Lewis & Haden, a private equity fund and serves on the boards of Tetra Tech, Inc., an environmental consulting company, and TSI, a publicly-traded closed end fund, of which he is also the Independent Chairman. Mr. Haden is a Rhodes Scholar and is also a member of the Board of Trustees of the University of Southern California.

Janet E. Kerr. Ms. Kerr serves on the board of CKE, Inc. Restaurants, a casual dining restaurant company, La-Z-Boy Incorporated, a residential furniture producer, Tilly’s Inc., a privately held retailer of apparel and accessories, and TSI, a publicly-traded closed end fund. Ms. Kerr is also a Professor of Law at Pepperdine University School of Law and is the founder and Executive Director of the Geoffrey H. Palmer Center for Entrepreneurship and the Law at the Pepperdine University School of Law. Ms. Kerr has founded several technology companies and is a well known author in the areas of securities, corporate law and corporate governance, having published several articles and a book on the subjects. She is also a member of the National Association of Corporate Directors and Women Corporate Directors.

Thomas E. Larkin, Jr. Mr. Larkin is Vice Chairman of the Advisor, TCW Asset Management Company, Trust Company of the West and The TCW Group, Inc. and serves on the board of the Automobile Club of Southern California, a motorist association. He is also a member of the Board of Trustees of the University of Notre

11

Dame, Loyola Marymount University and Mount Saint Mary’s College. He also serves on the boards of several philanthropic organizations including the Los Angeles Orthopedic Hospital Foundation, Childrens Hospital of Los Angeles, the Heart & Lung Surgery Foundation, American Red Cross and is a member of the Finance Council and Investment Committee of the Archdiocese of Los Angeles.

Peter McMillan. Mr. McMillan is the Co-founder and Managing Partner of Willowbrook Capital Group, LLC, an investment advisory firm, and co-founder and Executive Vice President of KBS Capital Advisors, a manager of real estate investment trusts. He serves on the boards of KBS Real Estate Investment Trusts I and II, real estate investment trusts, Steinway Musical Instruments, Inc., a manufacturer of musical instruments, the Metropolitan West Funds, a mutual fund complex, and TSI, a publicly-traded closed end fund. Prior to forming Willowbrook Capital Group in 2000, Mr. McMillan served as the executive vice president and chief investment officer of Sun America Investments, Inc. Prior to 1989, he served as assistant vice president for Aetna Life Insurance for Aetna Life Insurance and Annuity Company with responsibility for the company’s fixed income portfolios.

Charles A. Parker. Mr. Parker is a private investor and serves on the boards of Horace Mann Educators Corp., an insurance corporation, the Burridge Center for Research in Security Prices (Leeds School of Business, University of Colorado) and TSI, a publicly-traded closed end fund. Previously Mr. Parker was an executive vice president and director of the Continental Corporation and chairman and chief executive officer of Continental Asset Management Corporation.

Marc I. Stern. Mr. Stern is Chief Executive Officer and Chairman of the Advisor, Chief Executive Officer and Vice Chairman of TCW Asset Management Company and The TCW Group, Inc. and Vice Chairman of Trust Company of the West. He is a member of the Management Committee of Société Générale Group and Chairman of Société Générale’s Global Investment Management and Services (GIMS) North American unit. Mr. Stern serves on the board of Qualcomm Inc. and is a Director of Rockefeller & Co., Inc. In addition, he is a member of the Advisory Board and an owner of the Milwaukee Brewers Baseball Club. Prior to joining TCW in 1990, Mr. Stern was President of Sun America, Inc. He is Chairman and Chief Executive Officer of the Los Angeles opera. He also serves on the boards of several philanthropic organizations including the Performing Arts Center of Los Angeles County, the John F. Kennedy Center for the Performing Arts, the Museum of Contemporary Art in Los Angeles and the California Institute of Technology. Mr. Stern was recently appointed as a “Commandeur de l’Ordre National du Mérite” by the President of France.

The Nominating Committee will consider potential director candidates recommended by shareholders provided that the proposed candidates satisfy the director qualification requirements provided in the Company’s Directors Nominating and Qualification Charter and are not “interested persons” of the Company within the meaning of the 1940 Act, which is attached to this Proxy Statement as Appendix A.

12

Officers

The following information relates to the executive officers of the Company who are not Directors of the Company. The business address of each is 865 South Figueroa Street, Los Angeles, California 90017.Corporation.

Name |

|

| ||

Samuel P. Bell | Director* since 2002 | None. | ||

John A. Gavin | Director* since 2001 | None. | ||

Patrick C. Haden | Director* since 2001 | None. | ||

Janet E. Kerr | Director* since 2010 | None. | ||

Peter McMillan | Director* since 2010 | None. | ||

Charles A. Parker | Director* since 2003 | None. | ||

Victoria B. Rogers | Director* since 2011 | None. | ||

Andrew Tarica | Director* since 2012 | None. | ||

Charles W. Baldiswieler | Director since 2009, President and Chief Executive Officer | Group Managing Director of the Adviser, TCW Asset Management Company, and Trust Company of the West. | ||

Thomas E. Larkin, Jr. | Director since 1992 | Director of TCW and Trust Company of the West. | ||

Marc I. Stern | Director since 1992 | Director, Chairman and Chief Executive Officer of the Adviser; Director, Vice Chairman and Chief Executive Officer of TCW Asset Management Company; Director, Vice Chairman and President of Trust Company of the West; and Director and Vice Chairman of TCW. | ||

17

| Position with the | Interest in the Adviser | ||||

Michael E. Cahill | Senior Vice President, General Counsel and | Director, Executive Vice President, General Counsel and Secretary of the | ||||

Peter A. Brown | Senior Vice President | Managing Director of the | ||||

Hilary G.D. Lord |

| |||||

|

| Senior Vice President and | Managing Director, Chief Compliance Officer and Assistant Secretary of the | |||

David S. DeVito | Treasurer and | Director, Executive Vice President and Chief Administrative Officer of the | ||||

18

Name | Position with the | Interest in the Adviser | ||

George N. Winn | Assistant Treasurer | Senior Vice President of the Adviser, TCW | ||

| * |

13

Shareholder Approval

The Nominees for election as Directors at the Special Meeting will be elected by a pluralityInterested Persons of the total votes cast atCorporation and the Funds

Messrs. Baldiswieler, Larkin and Stern, each a meetingDirector of shareholders by the holdersCorporation, are deemed to be “interested persons” of the Corporation and the Funds, as defined in the Investment Company Act, because of their current ownership positions with TCW and their management roles with the Adviser and/or its affiliates. Accordingly, they may be considered to have an indirect interest with respect to the Proposal because the Adviser’s advisory services to the Funds would continue if the New Agreement is approved.

Control Persons and Principal Holders of Securities